About Safel Insurance Zimbabwe

One of the key business drivers for insurance businesses is offering a diverse range of products meticulously crafted to cater to the unique needs of their customers. Safel Insurance is committed to harnessing the transformative power of technology to optimize operational efficiency and elevate their service delivery to policyholders. To achieve this, they approached us with a set of goals in mind. Together, we are developing solutions that will boost employee productivity and customer service.

The Challenges that Inspired Safel Insurance to Innovate

The Solution

Safel Insurance needed a productivity boost for their agents in Zimbabwe in 2022. Their manual and inefficient systems slowed down the quoting process, especially for third party motor insurance, which had high demand and sales every day.

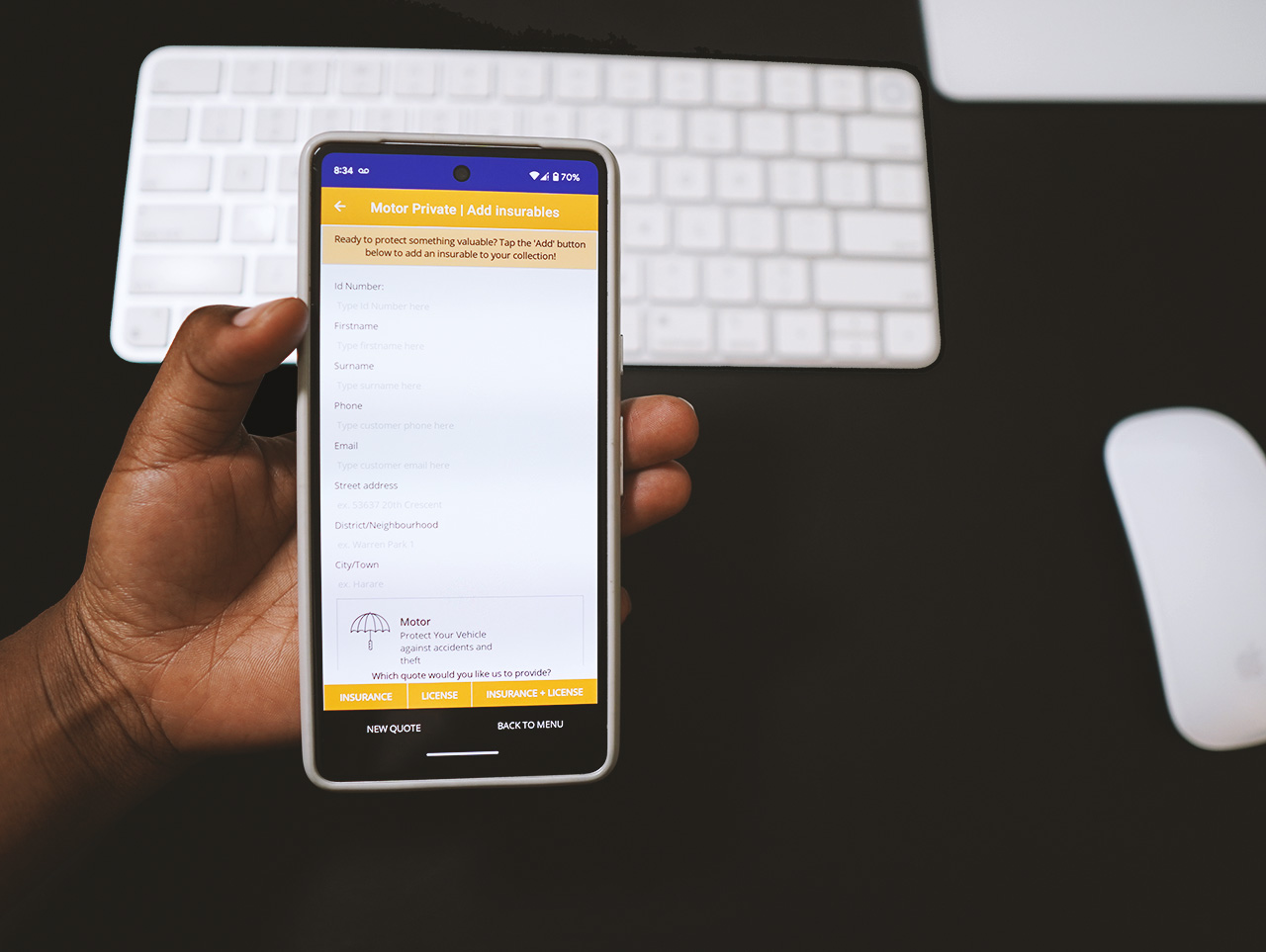

We aimed to create a lightweight solution that could speed up the quoting process using ubiquitous infrastructure. We explored various options and architectures to lay the groundwork for Safel Insurance’s digital services. In the first phase, we launched a mobile app that let agents generate quotes on the go. The app integrated with FluidTasks to give a unified view of the daily business across the country.

Hours reclaimed a month

"Thanks to Drimkoe's mobile application, Safel Insurance has undergone a transformative shift in our underwriting procedures. What used to be marred by human errors and time-consuming tasks has now become a streamlined and efficient process. Despite initial hesitations about the company's newness, the onboarding process was surprisingly smooth. The impact has been substantial – our operations are faster, and we've reclaimed 4 hours daily, redirecting them toward more strategic initiatives. I highly recommend Drimkoe's mobile application, especially for startups aiming to operate efficiently from day one."

Felix Chigwendere

Underwriting Manager at Safel